Whenever you go online and fill out forms or share your information, it is in danger of being sold to shady companies who use it to scam you. This might include banks, businesses, and even the government.

I was given an account by a company called Incogni that helps you stop this from happening.

They have about 180 data brokers on their lists. Once you create an account with them, they automatically start contacting them. Their algorithms predict how likely a broker is to have your information. None of your personal information is shared with them.

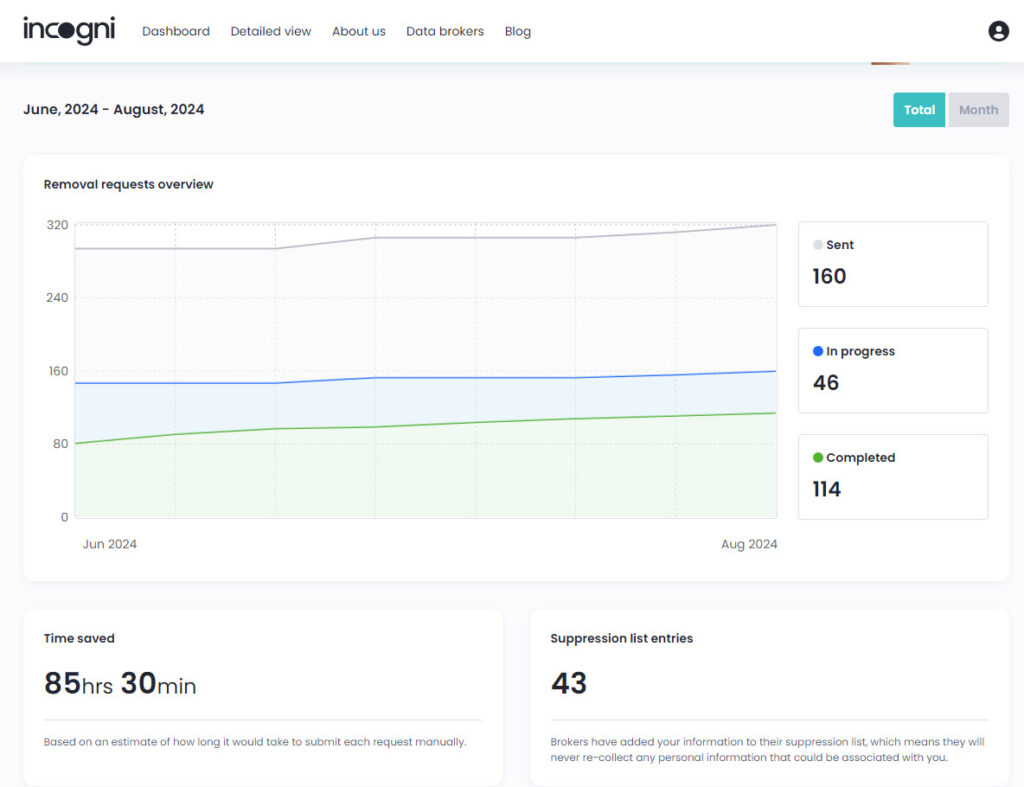

Inside your dashboard, you can see how many requests to these data brokers were sent, completed, and are in progress.

Incogni will delete your information from people search sites if you live in the USA. To test how effective it is, once the program is initiated you can go to https://www.searchpeoplefree.com to look for yourself.

You will also be able to see how many brokers have already removed your information and there is a suppression lists entries section that will tell you how many data brokers agreed not to re-collect your information again.

Why it is important to remove your data to prevent fraud

Elder fraud is running rampant. According to the FBI, Americans over 60 lost more than 3 Billion dollars to scammers in 2023. This can cause trauma and shame in seniors that can impact their health.

In 2023, Americans over 60 have submitted 14% more complaints to the FBI than in 2022. Financial losses rose about 11% over the same period.

Those losses do not include phone, mail, or in-person fraud. Often fraud victims do not report these crimes because of fear or embarrassment.

Seniors are more vulnerable to scammers as they tend to be more trusting and polite. Many have substantial assets such as homes, savings, and good credit that attract criminals.

Another reason is that seniors are not as adept at technology and may not be as savvy to potential scams they may come upon in email, social media, or other online sites.

The most commonly reported fraud involving seniors include dating sites, apartment rentals, online shopping deal sites, and investment schemes.

Call centers are notorious for stealing from seniors. You might want to watch a film called The Beekeeper on Apple TV. An elderly woman played by Phylicia Rashad is the victim of a phishing scheme and an ex-CIA operative goes to battle to destroy the operation.

Timeshare-related fraud is another way seniors are targeted and taken advantage of. Did you know that some timeshare companies are run by drug cartels? Other scammers pose as government officials or tech support agents and convince their victims to liquidate their assets or buy precious metals. Losses by seniors from this type of fraud exceeded $55 million in 2023.

My experience with fraud

Recently my Facebook page was taken over by fraudsters. I am normally pretty tech-savvy but slipped up and let this happen.

A person emailed and asked me to participate in a podcast. I have been on quite a few podcasts and thought nothing of it. They wanted to do it on Facebook and had me meet with one of their tech consultants to work out some tech issues. The man had me change a setting in my Facebook business account which was a big red flag I should have caught.

Soon after I found my Facebook page had been taken over and I no longer had any control over it. I tried to contact Facebook and saw a support number online. The person I talked to sounded like he knew what he was talking about. He had me go into my Venmo ( owned by Facebook) and managed to steal some money from me out of it. (the details of how he did this are too embarrassing to mention)

Luckily, Venmo support was REAL, and they returned my money. I learned that Facebook does not have phone support unless you pay to be verified. I had to start a new Facebook page for my blog but lost the one I’ve had since about 2011. Now I have 2 followers instead of 5,000.

My results from Incogni

When I was first approached to try out Incogni’s service, I wasn’t sure how it worked or what it was doing for me. But after letting the service remove my data from data brokers for over two months, these are my results.

You can also get more detailed results with company names, etc.

Incogni offers an annual or monthly plan which you can see here. And also a family and friends plan.

To get started with Incogni, click here.

How to prevent senior fraud

- If you believe you may be a victim of fraud, and are in danger, call the police ASAP.

- Do not answer calls that come up as Potential Spam and be careful with unsolicited calls, mailings, and door-to-door offers. That guy who calls saying he is raising money for the police is a scammer. Hang up.

- Do not click on any links you receive in texts, Facebook messages, or emails. Most are bogus and can hack your account.

- Always research a person you intend to work with and read all contracts thoroughly. Most legitimate businesses have websites, reviews, and testimonials.

- Do not send money to anyone you do not know.

- Be careful if someone pays you for merchandise upfront. This often happens when you sell something online on Facebook Marketplace, Offerup, eBay, or Craig’s List. A buyer will offer to pay you upfront or want you to text them instead of staying in the selling app. Only take their money in person in cash or get a Venmo or Paypal receipt in your phone before giving them merchandise. Never text them on your phone.

- Keep your computer up to date to prevent viruses. And just FYI, if you have Windows, all you need is Windows Defender. Some virus programs are invasive and slow down your computer.

- Avoid clicking on pop-up ads on your computer. If you can one that says your computer has been compromised and you need to pay money to fix it, shut down your computer immediately. Once you turn it on again, run a virus scan. It is usually BS. Above all, DO NOT PAY OR CONTACT THE SCAMMER.

- Never give anyone remote access to your computer to fix it unless you know them personally. That was how my Venmo was hacked. I could kick myself for being that dumb!

- Do not wire money to anyone. That includes that Nigerian Prince who always needs money fast.

- Change your passwords often or use a password manager. Use different passwords for each account and avoid using your dog or cat’s name, birthday, or anything obvious. Two-factor authentication apps are annoying but are very effective.

- If something looks too good to be true, it is likely a scam.

Incogni lowers the risk for potential fraud by deleting your information from various databases and people search sites. It cuts the access to your information from scammers at the source.

Awesome advice as usual. Thanks so much Rebecca!